Give More, Spend Less, Shop Local

I’m always surprised

by how much money I spend. I don't know why, because I’m pretty good about keeping my checkbook up to

date; but, when I go back and look at things it always catches me off guard how

much money I spend, especially on things I know I don’t need. As 2018 came to a

close, I came to the decision that I have to take proactive steps to curb

spending. My New Year’s Resolution is to give more but spend less, and try to

shop local when I can. We’re halfway through January and already I can hear the

books on my Amazon wish list calling out to me…

Do you do

this, too? It’s great how convenient the internet makes shopping. It makes

giving convenient, too. The internet is how I give money to charity (mostly to

Presbyterian Disaster Assistance) and to my church (online giving automatically

takes the money out of my account so I’m never waffling on how much to give.

And when it’s an automatic withdrawal, it’s a given that it will happen and

that holds me accountable. I can’t forget to write the check!). But convenience

comes with a price. I hear local businesses lament all the time that online

shopping has made it harder to stay in the black. People even said Black Friday

last year seemed anticlimactic because 1) Black Friday deals started before

Black Friday and 2) people can find online deals so much easier without the

stress of a store stampede.

In the

internet world, there’s a concept known as “friction.” Friction is the amount

of hoops you have to jump through to accomplish your goal online. Businesses

that practice online shopping want to have as little friction as possible so

that it’s easy for you to make your purchase and get on with your day. The pro

is that clicking one button makes shopping so easy. The con is that clicking

one button makes shopping too easy.

So easy, in fact, that we often don’t even think about it until after we’ve

made the purchase. There is little to no thought process required, and that's not always a good thing.

So I’ve

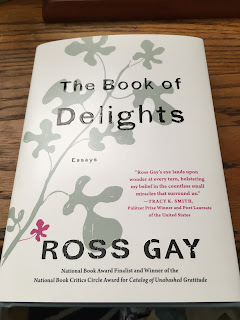

been working on this for me, because I know my spending habits. I know how easy

it is for me to hear about a book and immediately get on Amazon and buy it,

because I want to read it. And I’d say 70 percent of the time, I do read it

right away. About 20 percent of the time, I get to it eventually. And, I’m

sorry to say, about 10 percent of the time, the books come out of the box, onto

a shelf, and out of my mind. Did I really

need to buy that? Especially with how many books are in my house waiting to be read (my husband will emphatically agree with me on this one...so many books in the house waiting to be read!).

My local library

does this thing where they put a note on your receipt to tell you how much

money you saved by borrowing a book from the library. I’m reading Neil Gaiman’s

“American Gods” and the library receipt tells me when the book is due and that I saved $26.99 by borrowing it.

It’s a good reminder of how easy it is to save money by doing something as

simple as going to the library. At my library, you can borrow puzzles and

games, too. I can borrow books, movies, and music on the library app.

I’ve talked

a lot about books, but my biggest weakness is coffee. I use an app on my phone to upload

money from my debit card to my Starbucks account and that makes it so easy to buy

Starbucks. I’ve caught myself saying “and it didn’t cost me anything today

because I used the app.” Well, maybe not today. But it cost me something when I

added $20 to the app. I own so many coffee makers. At some point this

year I need to work on bringing that coffee spending number way down (and let's be honest, all that sugar in the Starbucks latte isn't doing my waistline any favors). Or at least, spending

less at the big chain coffee store and more on the local coffee shop downtown when I do need to spend time in an "other office" or meeting with people outside the office.

I've tried fixing some things, too, instead of immediately buying new. I'm learning how to repair t-shirts and my mom taught me how to hem pants. It's not always easy to shop local, especially when big-box stores and the internet offer things at cheaper prices. But it does feel good to support local businesses when I can, especially because the people who own the local businesses are a part of what make my community so great.

I hope that

if your goal this year is to track spending habits, you’ll share some ways that

you’re doing it. And celebrate the victories! I paid off all of my credit cards

right before Christmas. That was an AMAZING feeling. I’m still working on my

student loans and hope to have them taken care of by the end of the year. And I’ve

upped my giving to church. I still have some financial goals to reach before I’d

say I’m “financially healthy” but it feels really good to be working on it.

What are

your goals for the year? Are any of your goals financial? How can I encourage

you as you strive to meet your goals? And how will you know when your goals are

reached?

Comments

Post a Comment